Kennametal Completes Sale of Its Goshen, Indiana Subsidiary to Private Equity Firm!

By Ashutosh Arora

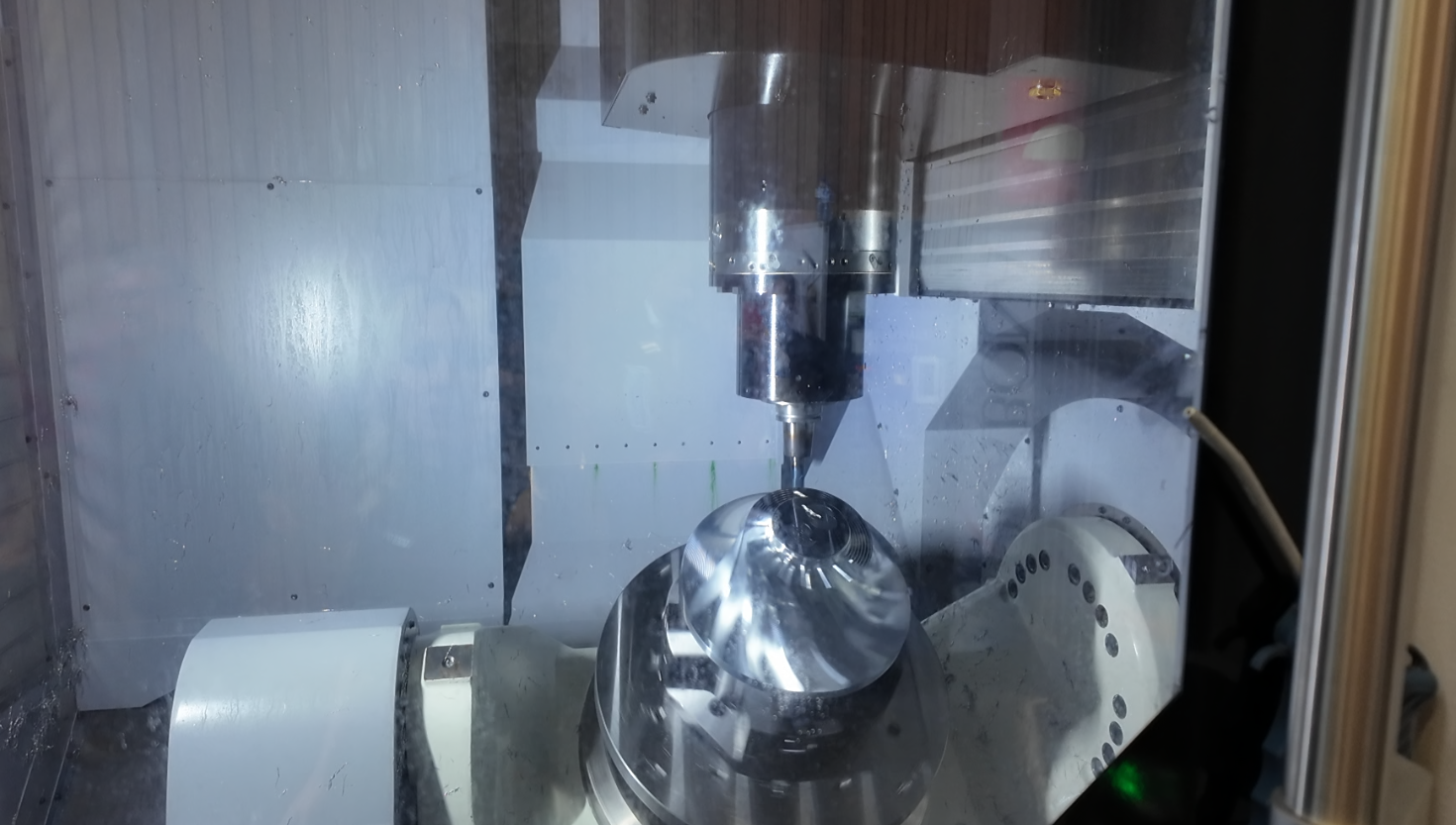

Kennametal Inc. (NYSE: KMT), a global leader in materials science and advanced manufacturing, has successfully completed the sale of its business in Goshen, Indiana. The subsidiary, known as Kennametal Stellite, L.P., is part of the company’s Infrastructure segment and specializes in surface coating and welding products. The transaction marks a strategic move by Kennametal to refine its sales mix, reduce material cost volatility, and allocate resources toward its long-term growth priorities.

The sale, which was concluded with a $19 million payment upon closing, is expected to have an immaterial pre-tax loss for the company. The proceeds from the sale, which are subject to post-closing adjustments, will be used for general corporate purposes. Additionally, Kennametal has an opportunity to earn additional proceeds through an EBITDA-based earn-out at the end of a three-year period. The buyer is a Chicago-based private equity firm, and the sale represents less than 2% of Kennametal’s total sales and is immaterial to its profitability.

Kennametal President and CEO, Sanjay Chowbey, emphasized that this portfolio action is an essential step in enhancing the company’s sales mix, improving its cost structure, and allowing the company to focus its resources on strategic priorities that will drive long-term value for stakeholders.

The sale of Kennametal Stellite aligns with Kennametal’s ongoing efforts to streamline its operations and strengthen its position in key areas of materials science and advanced manufacturing. The company remains committed to providing high-performance solutions across its core segments, including aerospace, automotive, energy, and industrial manufacturing.