Gabriel India Expands Manufacturing Capacity Through Strategic Acquisition of Marelli Motherson Assets!

By Ashutosh Arora

Gabriel India Limited has significantly boosted its production capabilities by acquiring manufacturing assets from Marelli Motherson Auto Suspension Parts Private Limited (MMAS), a joint venture between Marelli Europe S.p.A. and Samvardhana Motherson International Limited. The agreement, signed on January 24 and finalized on April 1, 2025, adds considerable capacity to Gabriel India’s operations and strengthens its position in the ride control systems market.

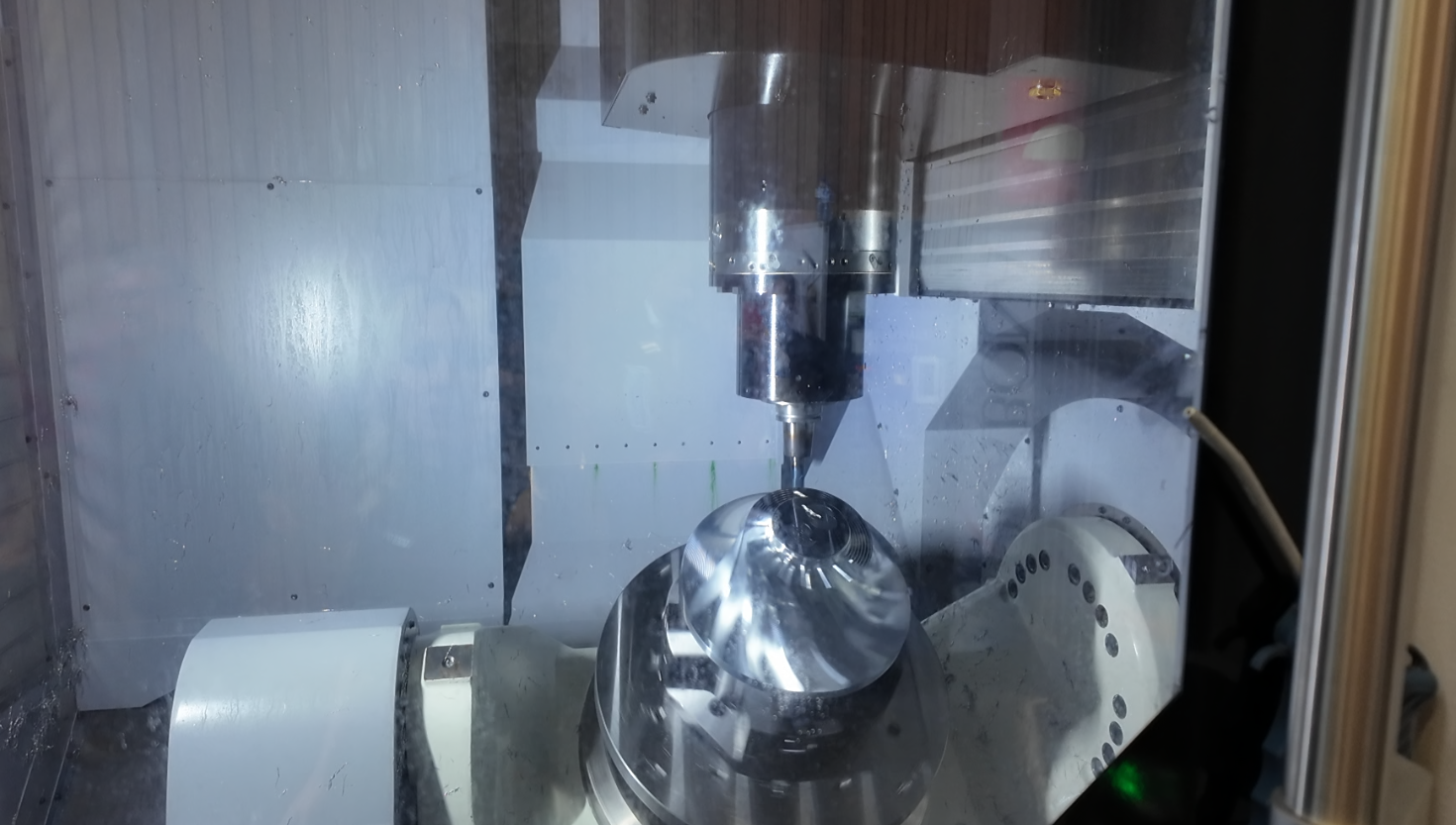

Through this acquisition, Gabriel India has gained the ability to produce 3.2 million shock absorbers and 1 million gas spring units annually. This expansion significantly enhances the company’s manufacturing output, allowing it to meet the growing demand in the automotive and electric mobility sectors. The addition of these manufacturing assets is in line with Gabriel India’s long-term growth strategy, positioning the company to increase its market presence and technological edge.

The deal also includes a technical and licensing agreement with Marelli, enabling Gabriel India to enhance its technological capabilities and expand its product offerings in the ride control systems market. This technical collaboration ensures that Gabriel India remains competitive by incorporating advanced ride control technology into its portfolio, ultimately improving product quality and performance across its diverse range of products.

This acquisition marks the first strategic acquisition by the ANAND Group for its flagship listed entity, Gabriel India Limited. According to Aditya Khanna, Partner at Grant Thornton Bharat, the transaction is a significant step in expanding market presence and innovation capabilities for Gabriel India. The acquisition enhances the company’s competitiveness and positions it for further growth, especially as it continues to explore opportunities in the electric mobility sector.

Sumeet Abrol, National Deals Consulting Leader at Grant Thornton Bharat, highlighted that this acquisition is the second automotive sector deal within just four months, underscoring continued activity and expertise in the field. This growing activity reflects the dynamic evolution of the Indian automotive sector, with companies like Gabriel India continuously adapting to meet the demands of both traditional and electric vehicles.

Gabriel India, a key player within the $2.2 billion ANAND Group, manufactures a wide range of ride control products for various vehicles, including two-wheelers, passenger cars, commercial vehicles, and railway systems. The acquisition is a testament to Gabriel India’s commitment to innovation and growth, as it seeks to build a stronger presence in the electric mobility sector and expand its global footprint.

The ANAND Group is a major name in the Indian automotive components manufacturing industry, with a rich legacy spanning over six decades. It comprises more than 20 companies, operating across diverse verticals such as ride control, sealing solutions, filtration, thermal management, and safety systems. The acquisition of these assets from Marelli Motherson further strengthens the Group’s extensive portfolio, enhancing its ability to meet the evolving needs of the automotive industry.

The acquisition of Marelli Motherson’s manufacturing assets by Gabriel India represents a strategic move to increase production capacity, enhance technological capabilities, and strengthen its position in the highly competitive ride control systems market. With this deal, Gabriel India is poised for continued growth, particularly in the electric mobility sector, while maintaining its commitment to high-quality products and technological innovation. As part of the ANAND Group, Gabriel India is well-equipped to meet the evolving demands of the global automotive market, positioning itself for a successful future in both traditional and electric vehicle technologies.