Collectively, high-value, long-life assets contribute greatly to society’s well-being. They are ingrained in our communications, defence, energy, food, health, transport and water systems.

Due to their importance, high-value assets are built to last a very long life. HMRC defines a long-life asset as one that would reasonably be expected to have a useful economic life of at least 25 years. An example of a very long-lasting asset is the Skerne railway bridge in Darlington, which is nearly 200 years old and still in operation. But not all critical assets are as old and as simply operated.

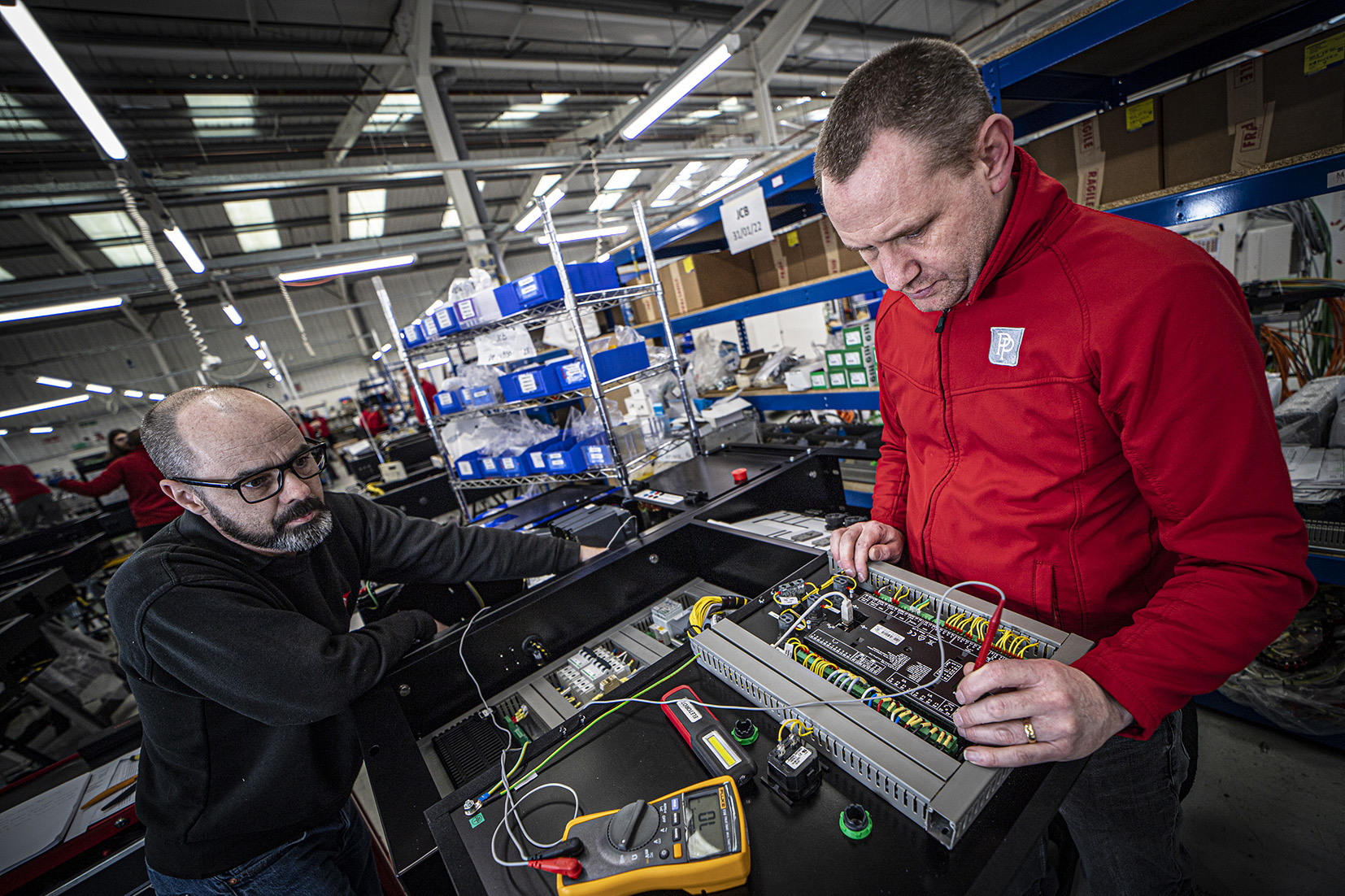

Modern high-value assets can indeed be very complex, with many components and interactions, and they are becoming smarter, capable of generating considerable amounts of operational data; some have even deployed digitised processes. Examples include modern aircraft, nuclear submarines, wind farms, and some specialist equipment/manufacturing facilities. All of these degrade, and some level of maintenance will eventually be required.

It is not difficult to anticipate the disruptive effects on our everyday lives, should any of these high-value complex assets suddenly stop being available. But who maintains them, and ensures their longer-term availability?

High-technology organisations with generally substantial budgets typically manage and operate these assets. For example, Network Rail operates Britain’s railway infrastructure assets, while the Ministry of Defence (MoD) ensures defence assets can be available as and when needed.

In the private sector, many other organisations also play a significant part in ensuring our societal well-being. All these organisations employ through-life or asset management professionals who are not only responsible for their assets’ continual operations, but also strive for ways to add value to their organisations by optimising operations, reducing operational costs, and creating new service options. The estimated potential economic contribution to the UK economy in 2018 was £31.4 billion[1].

International standards, such as PAS 280 or BS ISO 55000, provide useful guidance and terms of reference for organisations and through-life professionals. Four value streams have been identified, which are continuously applied to achieve tangible net benefit in value and cost outcomes for both the provider and customer:

- AVOIDphysical degradation of the asset. Design to maximise value potential – e.g., level and duration of usable functionality, whilst minimising potential support costs.

- CONTAIN Prepare and operate support assets to maximise operational availability, minimise operational disruption and minimise support costs.

- RECOVER Physically improve the available functionality through confirmation of available usable life by inspection and monitoring or health restoration by repair, replacement, or upgrade.

- CONVERTexperience to incremental value. Capture, analyse and apply the learning from AVOID, CONTAIN and CONVERT activities to identify and enact incremental improvements

The need for education and training of through-life professionals

It is clear that more through-life specialists/professionals will be required to sustain and improve the availability and quality of service of these high-value, long-life assets that we rely on. Some of the most critical skills include:

- Management of deterioration and obsolescence;

- Improvement of reliability and availability of assets;

- Estimation of value and cost effectiveness, business models;

- Diversification, service design and delivery, e.g., servitisation;

- Information technology and data analysis and management;

- Leadership, change management.

Cranfield University, together with a group of industrialists that include Rolls-Royce, MoD, BAE Systems, Leonardo, Bombardier, and Babcock, have put together a level 7 apprenticeship to train engineers capable of producing an immediate positive impact on the operations of long-life, high-value assets by deploying the PAS 280 standard principles.

The Through-life Engineering Services Specialist Master’s Degree Apprenticeship is a part-time course, which has been available for through-life and asset management practitioners since 2019. The first cohort graduated in June 2022, but the course syllabus builds on the successful executive MSc course Through Life Systems Sustainment, which has produced over 90 professional graduates, many of whom are in senior positions in industry. Current students come from a range of companies including MOD, Eurofighter, Rolls-Royce, Babcock, Thales, Network Rail, Leonardo, Croda, Volvo, GSK, BAE Systems, BMT Global and ABCAM.

Recent graduates have already seen their careers progressing. The course has intakes in March and October of every year and is available both as a standalone MSc and a level 7 apprenticeship (the apprenticeship levy funding scheme is available for qualified candidates).