🔊Asset Finance – Your next option for funding?

Asset finance has been a common form of funding for many firms over the years. However, for others, it remains less familiar. In this article, Close Brothers Asset Finance explores the different products available and explains why it could be the ideal choice when considering your next purchase.

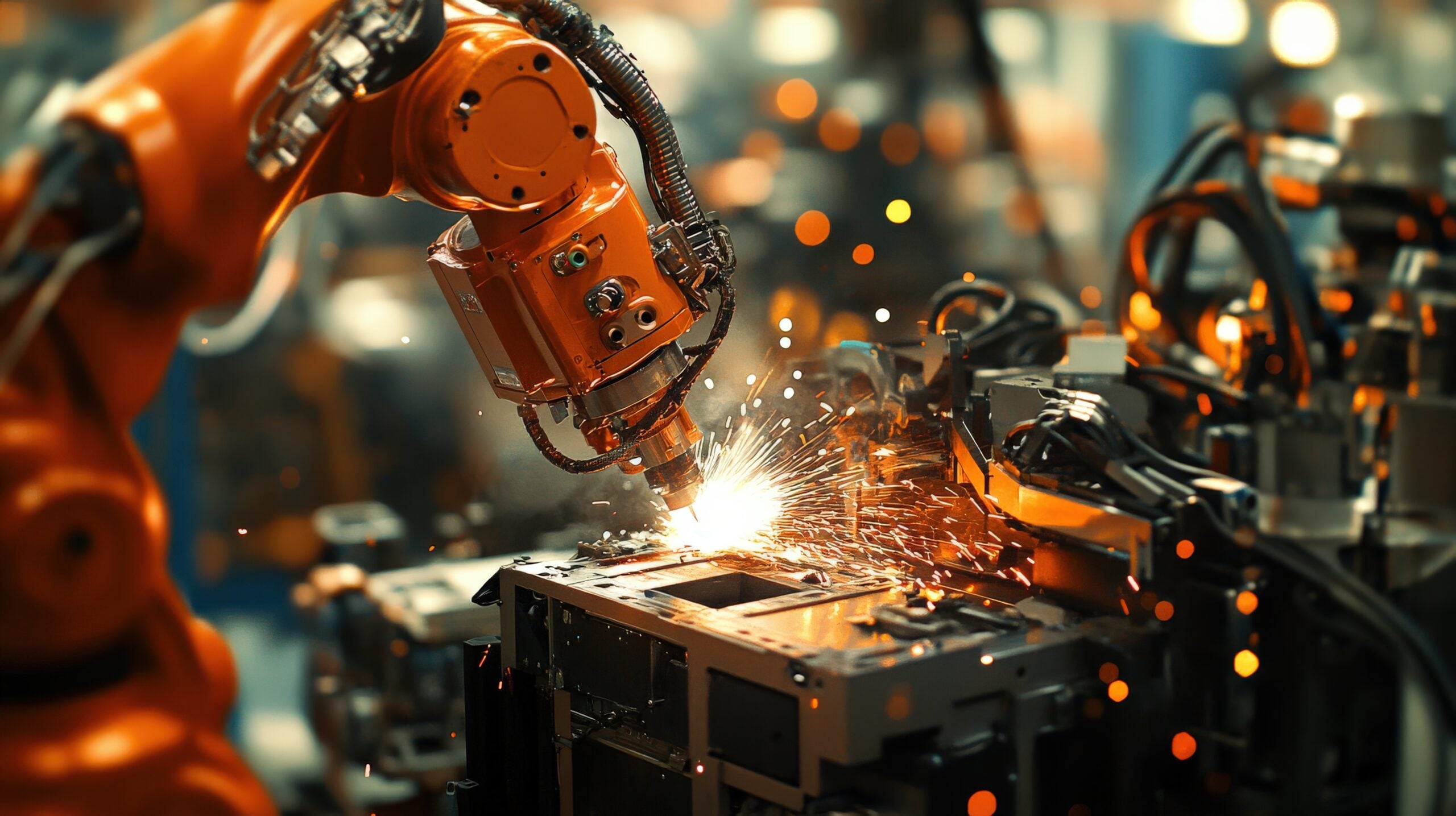

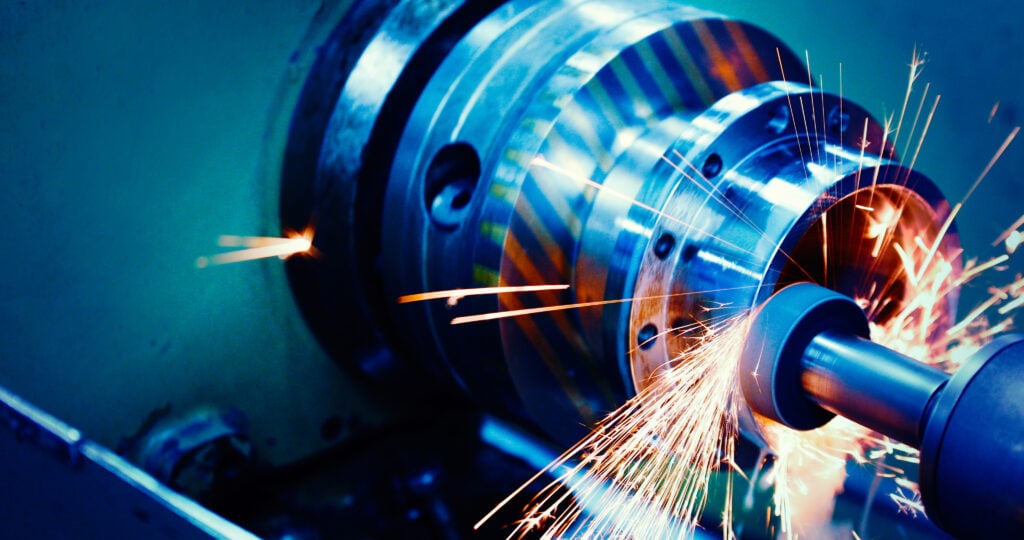

In brief, asset finance is an alternative funding method used by businesses to acquire the equipment they need for growth or to access vital cash. Asset finance makes the otherwise unaffordable affordable by providing businesses with access to essential equipment without the cash flow issues of an outright purchase.

Agreements can also be customised to the business’s needs, with flexibility on both the term and repayment schedule.

There are various products falling under the broad umbrella of asset finance, with one of the key ones being refinancing, which is a proven way to make your assets work for you and release cash back into the business.

How Refinance works

Refinancing leverages the value of assets you already own to support your business. With Sale and HP Back – a type of refinancing – you sell your equipment to us, and we lend you the funds needed to invest in your enterprise. You pay us back in line with what the equipment earns for you. Once you’re done paying us back, you own the equipment again. This works whether you own the equipment outright or are already financing it with someone else.

Who is Refinancing for?

Refinancing is available for anyone seeking to unlock the value of their existing assets to support their business. Whether you own equipment outright or are financing it elsewhere, refinancing can offer a quick way to access funds for items like new equipment, enhancing cash flow, or other business requirements. It’s a flexible option suitable for businesses of all sizes, including sole traders.

Benefits of Refinance

l Get more cash easily – Asset refinancing is a quick and simple way to get extra money for your business needs. You get to keep using the asset you put up as security.

l Pay over a longer time – We can take over your current financing deal with another company and extend the time you have to pay. The costs are fixed, so there won’t be any surprises while you’re repaying the loan.

l Choose what’s best for you – Use the cash injection for your business or buy other things you need. It’s more flexible than some other financing options.

l Decide quickly – Getting cash from your assets helps you make faster decisions when dealing with business contracts. Use the money for hiring people, buying new things, or expanding your workspace.

For more information, please visit: closeassetfinance.co.uk/asset-finance