US Automotive Sector Leads Robot Adoption, But Broader Manufacturing Still Lags Behind

The U.S. automotive industry continues to lead the way in automation, with 13,700 industrial robots installed in 2024, representing a 10.7% increase from the previous year, according to preliminary figures released by the International Federation of Robotics (IFR).

This growth cements the U.S. automotive sector as one of the most automated in the world. According to IFR President Takayuki Ito, the U.S. is now tied with Japan and Germany as the fifth most robot-intensive automotive industry, outpacing even China in robot-to-worker ratio.

“This is a great achievement of modernisation,” said Ito. “However, in other key areas of manufacturing automation, the USA lags behind its competitors.”

While the U.S. automotive industry drives the majority of industrial robot demand, broader adoption across other manufacturing sectors remains limited. The robot density — a key metric measuring the number of robots per 10,000 manufacturing employees — places the U.S. 10th globally, with 295 robots per 10,000 workers. In comparison, China recently overtook Germany and Japan with 470 robots per 10,000 workers, becoming the third-most automated manufacturing economy worldwide.

Despite being a global economic leader, the U.S. installed only 34,300 industrial robots across all industries in 2024. China, by contrast, installed approximately 280,000 units per year between 2021 and 2023, driven by its aggressive national robotics strategy and rapid industrial transformation.

A major factor limiting domestic production in the U.S. is the lack of local robot manufacturers. Most industrial robots used in the U.S. are imported, with Japan, China, Germany, and South Korea accounting for over 70% of global robot production. Among these, Chinese robotics companies have shown the fastest growth, tripling their output between 2019 and 2023 to meet booming domestic demand.

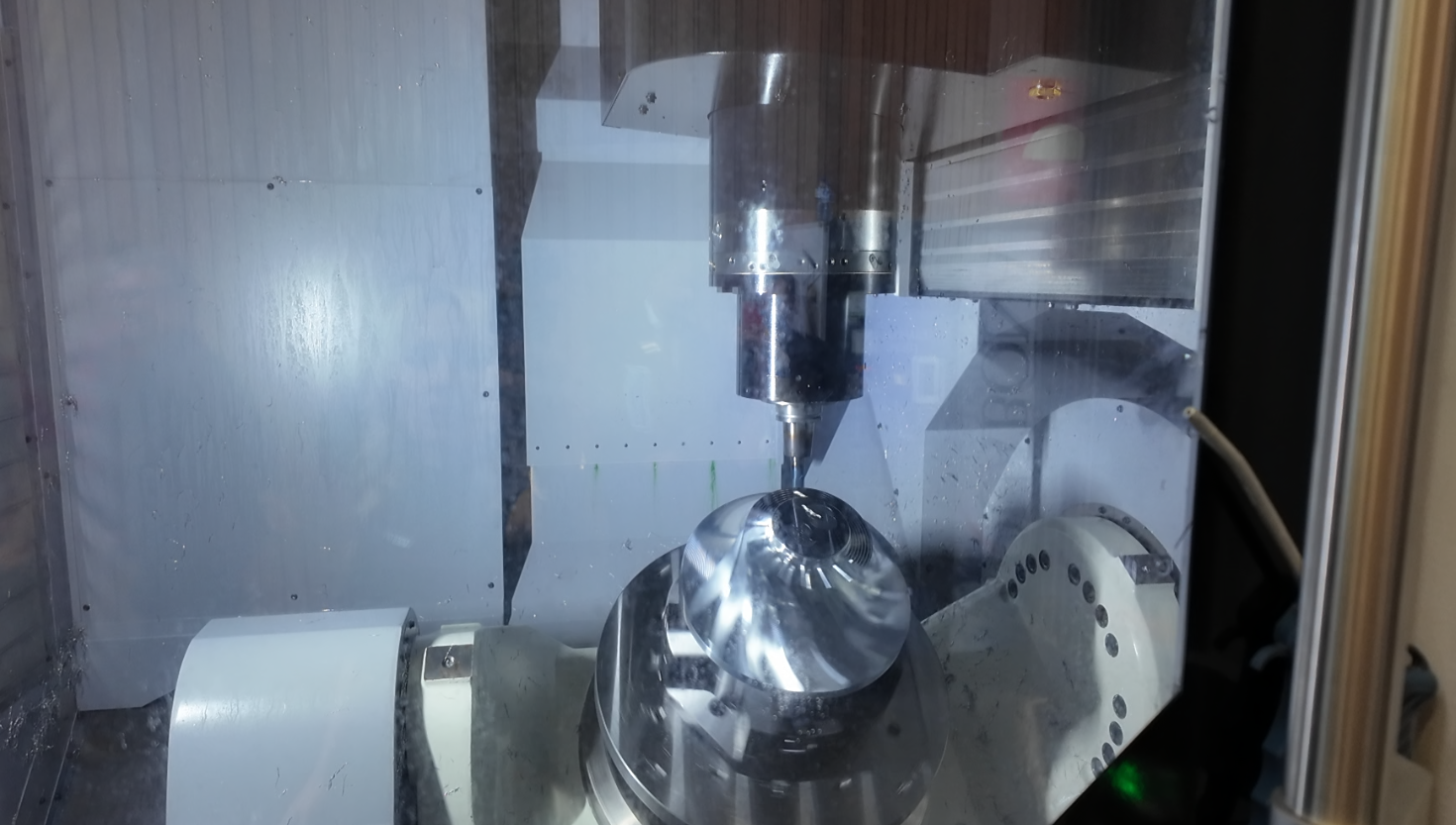

In the U.S., the automotive sector accounted for 40% of all new robot installations in 2024, followed by the metal and machinery industry with 3,800 units (11% market share), and the electrical and electronics sector, with 2,900 units (9% market share).

While the U.S. continues to excel in automotive automation, the challenge remains to broaden robot adoption across non-automotive sectors to maintain global competitiveness in advanced manufacturing.