SMEs make up the vast majority of HealthTech companies, a sector that employs over 138,000 people. While more elective surgeries will take place now the pandemic has passed, the UK needs to invest more in R&D to ‘keep pace with the global innovation race’*.

By Will Stirling

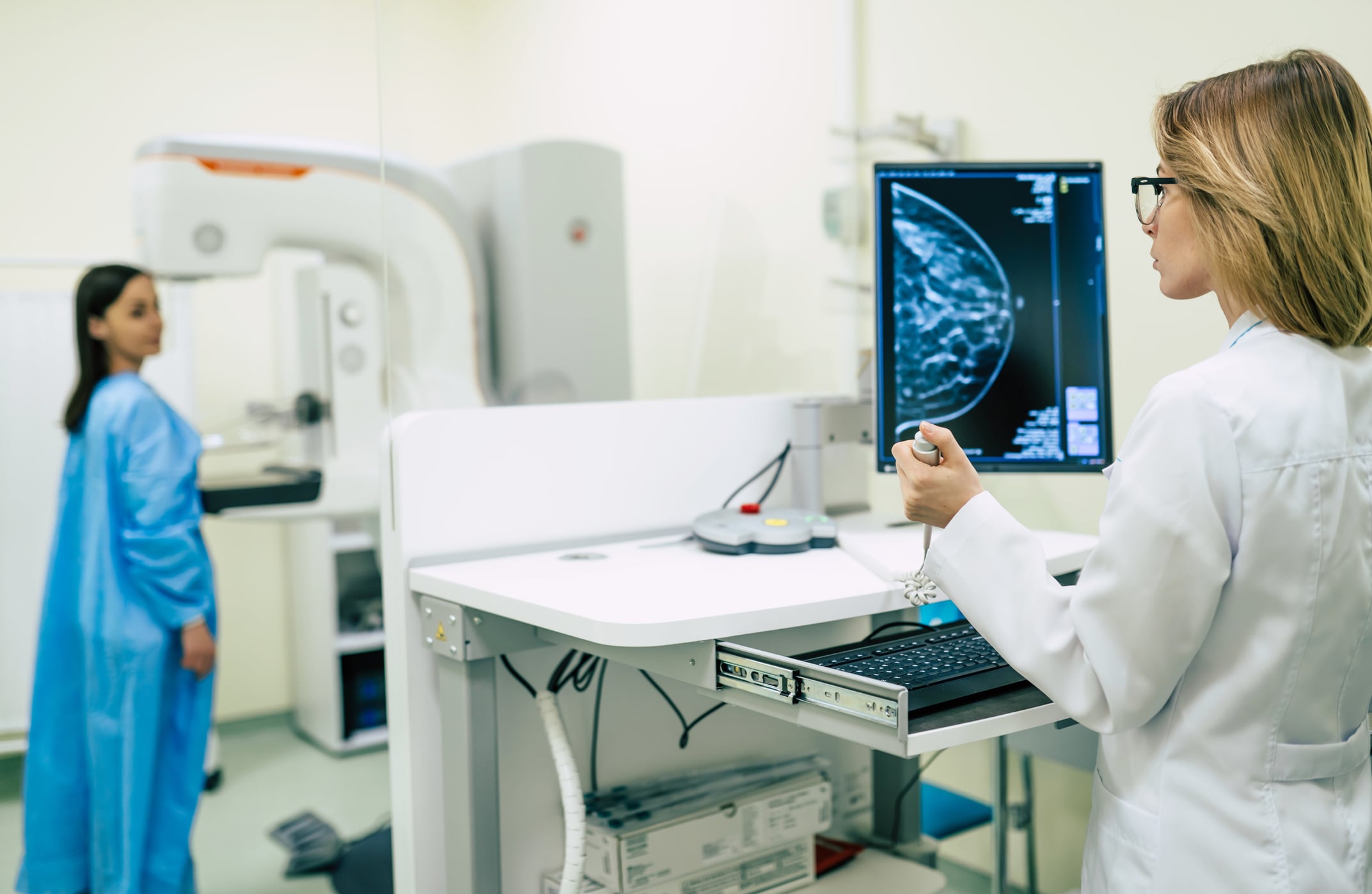

Medical device manufacturing is a very entrepreneurial and fluid industry within the broader life sciences industry. The products are highly engineered, increasingly with digital or ‘smart’ functions, and often high margin – although this depends on the product. It also has a high number of start-ups, mergers and acquisitions. Reasons include that health (for many) is not optional, plus the attraction of a reliable, deep-pocketed prime customer, the NHS, and the sector covers so many disciplines of engineering and technology. Then there is population growth, and that technology reduces barriers to entry.

It has a strong forecast too. The Association of British Healthcare Industries (ABHI), the industry body, says there is an increasing amount of ‘other’ technology i.e., beyond mechanical and electronic, essential to the delivery of modern healthcare today, that will remain vital in 10-years. The UK population is predicted to both grow and age, from 65.6 million in 2016 to over 74 million by 2039, and older people need more medical treatment.

The government defines ‘Core Med Tech’ as all businesses whose primary business involves developing and producing Med Tech products, ranging from single-use consumables to complex hospital equipment, including digital health products. This might be more broadly defined as HealthTech, covering the devices and machines and the digital platforms that add value to these. HealthTech is the largest employer in the life sciences sector, employing 138,100 people in 4,140 companies, with a combined turnover of £27.6bn (Source: ABHI). The industry has enjoyed growth of around 5% in recent years and it is dominated by SMEs.

Digital medical devices combine the older disciplines of device design and manufacture with sensors, data capture and presentation for monitoring, and increasingly use artificial intelligence. The biggest trend is the rise in companies that bolt on digital services to the physical product that can be sold as a product or subscription service.

The investment made in recent years has given British medical device (or Med Dev) companies a boost. As well as albeit changing – demand from the NHS, private hospitals and exports – manufacturers, today can harness machine learning, nanotechnology, materials such as graphene, simulation software and DNA decoding technology.

Challenges

One problem with more Med Dev growth is that British R&D spending, which totalled £38.5bn in 2019, is among the lowest in OECD countries as a percentage of GDP – just 1.7%. The strategy aims to increase public and private R&D investment to 2.4% of GDP by 2027, and this includes raising annual public investment in R&D to £22bn, from nearly £15bn in 2021-22. There is also a big challenge to increase elective surgical procedures after Covid sucked out hospital capacity with finite human resources, especially surgeons and nurses.

MTD looks at some of the exciting British medical device and HealthTech companies.

JRI Orthopaedics

Arthroplasty implants are a substantial segment of the medical devices sector and have faced challenges from both funding of the NHS – its primary customer – and Covid. The pandemic created a huge backlog of elective surgical procedures, and fierce competition has pushed the unit price of implants down over the past decade or so.

JRI Orthopaedics, an arthroplasty company in Sheffield, designs and makes a range of implants that include hip and knee replacements, shoulder products and orthobiologics. Pre-Covid, NHS funding restricted the throughput of elective operations, limiting orders for JRI and other implant companies, and then Covid increased the waiting list massively. Frustratingly the demand, the patient need, is huge. “One stat showed that if the NHS worked at 120% it would take six years to return to the position the industry had in 2019,” says head of sales, Gareth Horton. “That position has slipped again because it is not working at 120%; regional differences aside probably it’s working at 80% at best.”

The GIRFT Report recommended the NHS provide centres that specialise in arthroplasty operations like hip and knee replacements, where surgeons could focus on these procedures and complete four to five joint replacements a day. This has not yet materialised and the rate is at two to three operations a day, so the backlog persists. “Reasons for slow throughput are that there are so many more Covid protocols in theatre to work through and staffing levels have fallen.”

Despite this, the surgery pipeline is picking up in the UK and abroad ‘post-Covid’ and JRI Orthopaedics is well placed. It offers both a customised and standard range of medical implants, items at industry-certified standard sizes that surgeons can pick off the shelf, and parts

designed as one-offs. “The NHS needs a credible alternative supplier to the very large global companies whose model is suited to high volume, standard products only – that does not suit all cases,” says Gareth. Materials used are typically stainless steel, titanium and cobalt chrome. JRI employs 90 people, exports products globally and is now part of the AK Medical Group.

CMR Surgical

This Cambridge-based company manufactures surgical robots and is flying high with the Versius Surgical Robotic System, its flagship product. In June 2021, CMR completed a £600m Series D funding round (co-led by Softbank Vision Fund 2 and Ally Bridge Group), notably the biggest-ever private MedTech raise. That money is being put to good use – in 2021 CMR announced plans to build a new global manufacturing hub in Cambridgeshire, for completion in 2023. The new facility will span 7,044.8sq/m floor space and employ up to 200 skilled employees, initially from production, quality, manufacturing engineering, supply, operations, and logistics, with 100 new jobs expected to be created between 2023-2025.

Since the start of 2021, the Versius system has been launched in Germany, Australia, Italy, Poland, Egypt, Pakistan and Hong Kong, joining other markets across Europe, Asia and the Middle East. Versius has also been introduced in Wales as part of a ‘first-of-its-kind’ National Robotic-Assisted Surgery Programme in partnership with NHS Wales and LifeSciences Hub Wales.

Brandon Medical

Brandon Medical recently won a Queen’s Award for Innovation, for its Intelligent Theatre Control Pane (iTCP), a smart communication and control system for operating theatres. iTCP is the first operational technology (OT) control panel that talks to the building management system and the operating theatre equipment, using smart building protocols to include Operating Theatre Smart Integration (a form of IoT). The system is 100% designed and manufactured in the UK. Hospital operating theatres have until now been disconnected from the Building Management System – the company says the iTCP is creating the smart operating theatre, integrating acute care areas into the digital hospital. The modular concept of iTCP allows for de-risking operating theatre projects, and it has an in-built capacity to absorb and connect with new clinically driven technologies and equipment not invented yet.

“Brandon Medical’s unique intelligent Theatre Control Panel provides clinical staff with an intuitive user interface to easily control the suite of operating theatre equipment and detailed technical information to hospital engineering teams for routine maintenance and condition monitoring,” says Keith Jackson, CEO and visiting professor at The University of Sheffield.

Gendrive

A University of Manchester spin-out, Gendrive’s bedside intelligent monitor identifies whether a critically ill infant has a gene that could result in permanent hearing loss if they are treated with a common emergency antibiotic.

Patients admitted to intensive care are usually given an antibiotic called Gentamicin within 60 minutes. This drug is used to safely treat about 100,000 babies a year, but one in 500 babies carries the gene that can cause permanent hearing loss. The new test means that babies found to have the genetic variant can be given an alternative antibiotic within the ‘golden hour.’ The test could save the NHS £5m annually by reducing the need for other interventions, such as cochlear implants.

Investment in Med Dev

• Ortho Clinical Diagnostics UK will expand its biological diagnostic product lines at its Pencoed site in Wales.

• Randox Laboratories, famous for its Covid-19 testing kits, is building a large new manufacturing facility in Northern Ireland with state backing.

• Piramal Healthcare is undertaking a facilities upgrade at its Morpeth site in Northumberland, where it develops, manufactures and packages a broad range of medical products.