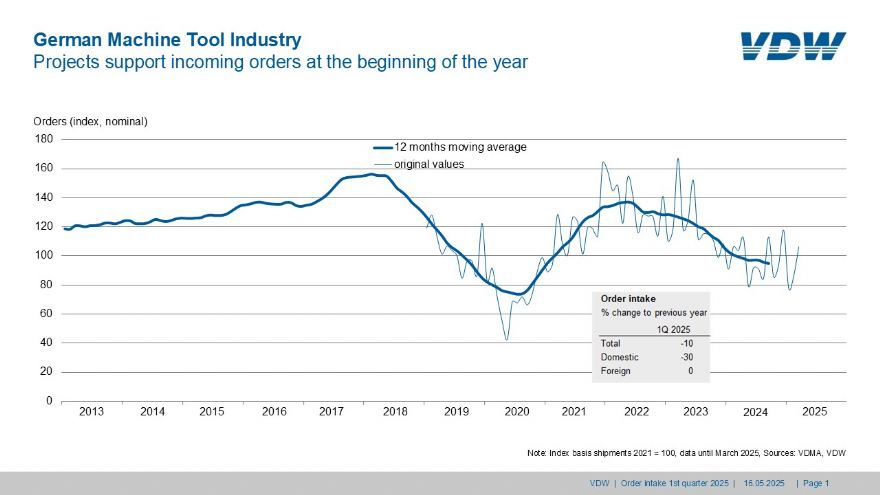

German Machine Tool Orders Down 10% in Q1 2025 – Overseas Markets Offer Glimmers of Hope

The German machine tool industry has reported a 10% decline in orders for the first quarter of 2025 compared to the same period last year, according to the latest figures released by the VDW (German Machine Tool Builders’ Association). The downturn is largely attributed to a 30% slump in domestic orders, while foreign orders remained stable year-on-year.

Dr Markus Heering, Executive Director of the VDW, acknowledged the industry’s sluggish start to the year but noted a modest recovery in March, with a 2% uptick in orders — driven primarily by demand from abroad, especially within the Eurozone. “This is an initial positive signal,” Dr Heering said, “but the German domestic market continues to fall well short of expectations.”

Europe remained the strongest sales region in Q1, with several key countries showing improved purchasing activity. Though growth was measured from a relatively low base, the region expanded by almost a third, reinforcing Europe’s position as the top export destination for German machine tools.

In a notable shift, Asia ended its downward trend, achieving 6% growth and signalling renewed momentum. China, in particular, has shown slight positive growth for the first time in an extended period, once again becoming the most important single market for German machine tool exports — surpassing the USA.

On the American continent, growth was primarily supported by project demand from Mexico, while the USA saw a 10% drop in orders. Still, Dr Heering underscored the long-term potential of the U.S. market, stating: “US industry still relies heavily on German manufacturing technology for its modernisation efforts — there simply aren’t enough domestic alternatives.”

According to a recent VDW survey, medical technology and aviation remain the strongest sectors driving demand, while the general engineering sector is beginning to show signs of recovery. However, persistent challenges remain. The automotive industry continues to struggle, and export controls and high production costs are hampering wider industry recovery.

Dr Heering concluded with cautious optimism: “It is too early to speak of a trend reversal. The global economic climate remains uncertain — particularly due to the unpredictability of current US trade policy.”

As the sector navigates these challenges, EMO Hannover 2025 will provide a key platform for German manufacturers to showcase innovation and resilience in the face of global headwinds.