🎧Digital factories key to MedTech’s growth in tough conditions

Lifestyle-related illnesses, an ageing population and personalised health are some of the medical industry’s growth drivers. Manufacturers are using digital technology, from digital dental labs to polymorphic moulds, to win orders and battle tough trading conditions. Will Stirling reports.

Over 5.8 million people in the UK are living with diabetes, the highest number on record. The prevalence of type 2 diabetes has nearly doubled in the last 15 years, linked to lifestyle factors such as obesity and high-sugar diets. People are living longer and require mobility and care technology for extended periods. This exemplifies a growing and concerning burden on the NHS, while also presenting a significant business opportunity.

The manufacture of hard medical products – surgical instruments, tooling, prosthetics, orthotics, and devices like wheelchairs and beds – encompasses a broad range, particularly when including consumable devices such as single-use plastics. ‘MedTech’ typically refers to medical products with embedded digital technology, which includes diagnostic and monitoring devices. However, as more smart medical technology is developed, the division between machined or moulded parts and ‘digital tech’ is becoming increasingly blurred. The UK MedTech industry has an annual turnover of £27.6 billion, placing it just behind the aerospace sector (about £30bn).

The UK exports £10.1 billion worth of MedTech products annually (2023), but it still faces a trade deficit of £5.4 billion as imports exceed exports. High tariffs on UK-manufactured goods traded with the US increase pressure on this deficit, but there may be a twist. UK medical devices are subject to a flat 10% tariff, which is significantly lower than the high tariffs imposed on Chinese, Asian, Canadian, and Mexican imports, potentially benefiting some UK device exports.

The NHS spends up to £18bn annually on medical equipment, consumables, and MedTech—everything from syringes to MRI scanners, a vast domestic market for UK designers and manufacturers to access. So, it’s little surprise that it’s rich with engineering and business innovation.

MedTech is being affected by the same trends as other manufacturing segments: digital technology, sustainability, cost reduction pressure, new materials, and new or fast-developing manufacturing technologies. 3D printing and polymorphic moulding are used increasingly in device manufacturing, such as in Prosthetics and Orthotics, aka ‘PO’, and specialist CAD/CAM software is utilised for digital dental manufacturing. The PO industry is worth £274m in 2024. Growth in prosthetics is fueled partly by amputations related to type 2 diabetes, and in orthotics by child mobility and disability needs. About 260 businesses operate in the PO sector, which surprisingly has 24% higher productivity compared to the entire healthcare sector (Source: BHTA, Healthtech’s economic impact in the UK).

Light the Fyous

Orthotics are externally applied devices used to influence the body’s function. They can be applied across the body but are most used to support the feet and lower legs. Foot orthotics are custom-made supports for the patient. Here, conventional mould tools used to make a plastic mould are uneconomic—short-run batches don’t cover the tool cost.

Fyous, the Sheffield-based polymorphic moulding technology provider, uses a proprietary pin tool with 28,000 pins to create a customised, ‘shapeshifting’ mould in around 20 minutes. It recently partnered with Peacocks Medical Group, the UK’s largest independent orthotics company, to use the polymorphic technology for its products.

“This collaboration shows how polymorphic moulding can help the production of lasts (foot orthotics), cutting waste and costs, and improving efficiency,” said Joshua Shires, CEO and Co-Founder of Fyous. “Early adopters like Peacocks will gain a competitive edge as the industry moves towards more sustainable, digital-first manufacturing.” Fyous is now developing its pin technology to address the diabetic foot care market, where the NHS spends nearly £1bn a year on diabetic care.

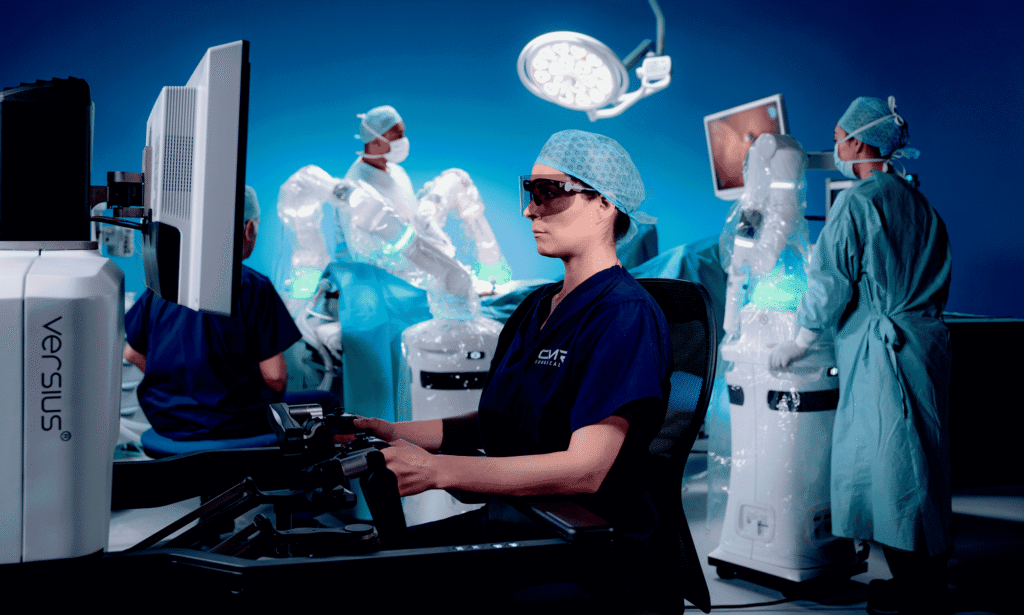

Several British MedTech companies are attracting big investments. In April, Cambridge-based robotics company CMR Surgical closed a US$200m funding round with a mix of equity and debt capital from investors Trinity Capital. The funds will be used to expand CMR’s flagship Versius Surgical Robotic System to more hospitals globally, with a focus on the US market, and to support the launch of the enhanced Versius Plus. In 2021, CMR’s private funding pushed above £1bn, valuing the company at $3bn.

“We are now at a pivotal stage, poised to capitalise on significant opportunities for market expansion, including in the U.S, while penetrating deeper into expanding markets,” says CEO Massimiliano Colella.

Cutting into the booming digital dental market

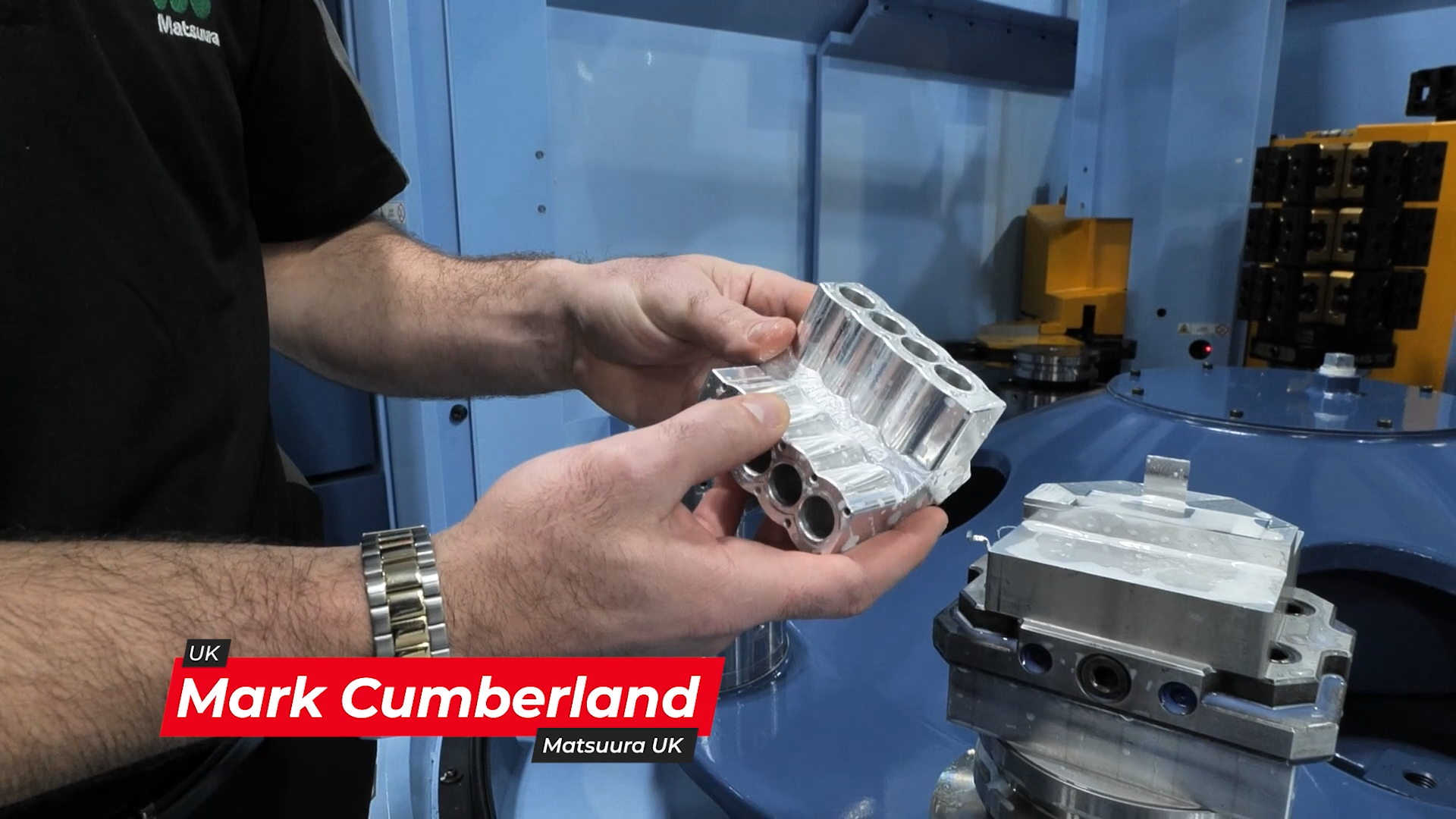

Digital technology has allowed the production of dental implants and restorations to change rapidly. Today, many digital manufacturing labs can provide uber-accurate dental implants, crowns, and tooth sets in multiple materials in quick delivery times from 3D models of teeth supplied by dentists. These labs need the best milling tools to machine these implants accurately.

Nine months ago, dental lab Optadent contacted high-precision tooling company Quickgrind to supply a two-flute, ball nose tool with 5mm extra reach. Optadent was compromising its CNC machining strategies; Managing Director Anthony Wainwright felt this could be improved by moving from standard tools from dental consumable distributors, to using a bespoke manufactured tool. Quickgrind’s Total Solutions Engineering Strategy, a custom-made tooling service, was a perfect match. Material versatility is key in dental implants, and these tools are designed to machine the main specialist dental materials – chrome cobalt, titanium, zirconium oxide, PMMA, PEEK and wax.

This engagement showed Quickgrind a relatively new and booming global, digital business – an industry within an industry.

“Since spotting the opportunity we have worked closely with digital machining dental lab owners & technicians, machine tool manufacturers, machine tool distributors, CAD/CAM developers, CAD/CAM resellers, CNC application engineers and academics, to build our knowledge and understand how the market is growing and what may limit the speed of growth,” says Technical Support Manager Mark Aspinall. You can read the full story on page 52 and 53.

Hold your nerve and keep innovating

Amies is a 96-year-old, family-owned injection moulded component and assembly manufacturer. Over the last 20 years, the company has steadily built its medical business so that it now exceeds 50% of turnover across a diverse customer base in medical devices and IVD products.

“Over our long history, we have learned that the best strategy is to maintain a solid and reliable technical base, such as the fleet of modern Arburg IMM machines we operate, while keeping fully aware of new technologies and materials as they develop, with a view to early adoption,” says Managing Director Simon Stewart-Smith.

As regards innovation trends, Amies is increasing its use of in-house additive manufacturing in the development phases of medical projects and even most recently, some early pre-series production runs of complete assemblies. There is a lot of interest in eco-materials, too. “We are delighted to be engaged in some exciting, top-secret projects around a promising bioplastic that are progressing well,” Simon adds.

“We are all operating in a challenging environment now, with many challenges coming from changes imposed by governments both home and abroad, but there is every reason to be optimistic that by remaining agile and focused, we can remain strong and continue to steadily grow.”

Tariffs and turbulence put the brakes

on medical’s potential

Like other sectors, medical devices face troubling conditions, not only US tariffs causing mayhem in supply chains. “The MedTech and HealthTech sectors currently face an unprecedented array of challenges; employers’ NI increases, trade tariffs, regulatory uncertainty, post-Brexit trading status with the EU, NHS reform, the need for social care reform, the list goes on!” says David Stockdale, CEO of the British Healthcare Trades Association.

“With so many moving parts and burdens placed on these sectors, it is an incredibly challenging market to be in. That said, there are opportunities, as innovations come into the market, coupled with an ageing population, there is growth potential here – it is just hard to see amid all the turmoil. It is important that the government better understands the sectors, who to support and to work with them at this time to help them flourish.”