🎧 – Additive shift to deliver both volume and custom parts

Big trends in medical device manufacture include the growing movement into digital devices, a shift to more 3D printed implants, and signs that global medical primes are bringing more manufacturing in-house possibly due to UK supplier constraints. Will Stirling reports.

Despite efforts to reduce plastic consumption, the segment that produced the highest value of turnover in 2021 was single use (SU) technology. It generated £3bn in turnover in 2021, 10% of the total turnover in the medical technology sector in 2021 and a 53% increase from 2020. The biggest segment for employment in 2021 was digital health, at 11% of the total. Orthopaedic devices, which is one group of parts that MTD readers would typically manufacture, represents just 5% turnover and 4% employment. This probably says more about the growth of digital and SU, because elective operations like hip and knee joint replacements are back after a long period where Covid and then life-threatening surgeries dominated hospitals.

Kirkstall Precision Engineering is seeing that recovery. Active in the medical sector since 2000, today medical and veterinary devices combined make up over 87% of sales and this is growing. Iqbal Bahia joined the company in 2018 with a strong manufacturing background and was appointed Managing Director in 2022. With the leadership team, he set a strategy for growth centred on offering large medical device OEMs a reliable and flexible end-to-end Contract manufacturing service. The business has ISO: 13485, the medical devices standard with scope being extended this year to include design and implant manufacturer and has just passed its phase 1 audit for the ISO: 14001 environmental standard. The medical sector is a demanding niche, Iqbal Bahia says, because the instruments must fulfil the highest requirements in safety, reliability and functionality as well adhering to rigorous regulatory rules. This is where the company strategy has focused.

“We do not own a component design,” says Bahia. “We are end-to-end contract manufacturers, we own the device manufacturing IP and will help with design, prototyping, IP, validation, manufacture, and assembly. We are positioning ourselves as a one-stop-shop ‘solution provider’, for example with our veterinary products we produce the tray and instruments in a full kit.”

“We do not own a component design,” says Bahia. “We are end-to-end contract manufacturers, we own the device manufacturing IP and will help with design, prototyping, IP, validation, manufacture, and assembly. We are positioning ourselves as a one-stop-shop ‘solution provider’, for example with our veterinary products we produce the tray and instruments in a full kit.”

Like all businesses, Kirkstall Precision was hit hard by the pandemic – orders fell by 60% almost overnight. But it took the long-term view and increased investment, deciding that medical would bounce back strongly post-pandemic and would need high capacity suppliers with the standards and processes to deliver. They were correct – the order book is now strong and Kirkstall has established a name for quality and reliability.

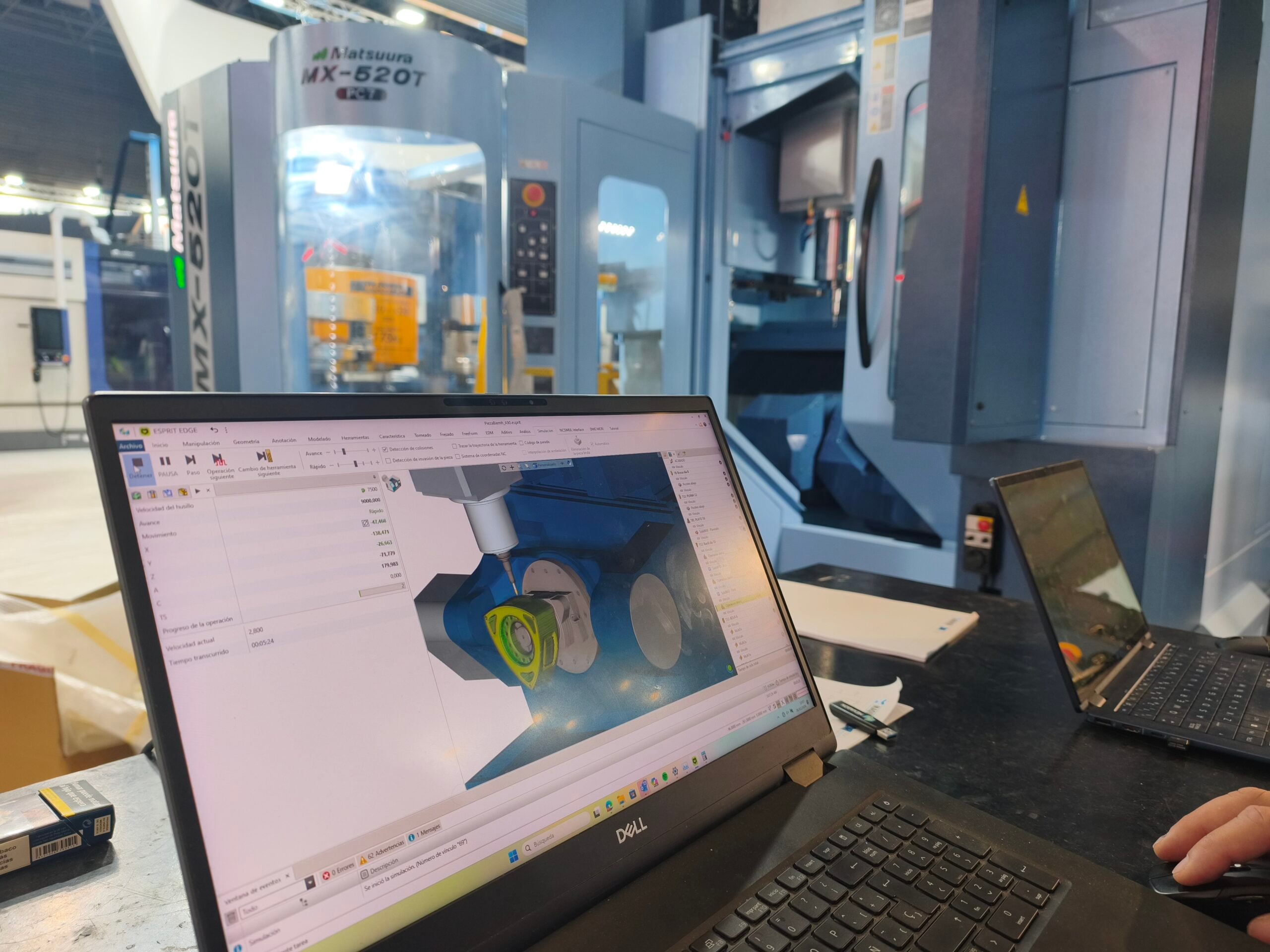

New recent investments include a Matsuura MX-330, costing just under £450,000, two new Star sliding head lathes, an optical measuring machine, and a GF Cut E350 EDM machine for unmanned machining. It also invested heavily in a new Business Management System, covering ERP, MRP, CRM and QMS (quality management) – with a production planning and scheduling package on the way. Iqbal Bahia places much credit on the new IT system, supplied by Access, for Kirkstall Precisions’ ability to deliver a demanding order book and manage challenging material inputs.

“The cost and delivery time of various grades of stainless steel, our biggest material, has risen hugely,” he says. “People are now committed to forward orders to guarantee the continuity of supply. We have invested further so we can produce around the clock.” Its core product families are orthopaedic instruments for global OEMs, joint surgery, knee replacements, hip replacements, and spine alignment.

Additive manufacturing goes mainstream

Launched in 2019, Renishaw’s RenAM 500 series is a metal additive manufacturing (AM) machine that is proving popular for medical device manufacture. It comes in a single laser and four or ‘quad’ laser – the 500Q – variants. The 500Q prints small and medium-sized parts at a lower cost point because it has much higher productivity than a single laser. There is also a 500 Flex variant, launched in 2021, designed for different material testing. “The Flex is good for swapping materials in and out, we find some customers start with the Flex to trial applications and then move on to the Quad (500Q),” says Marcomms Manager for Additive Manufacturing, Ella Rees.

There is a growing trend for medical device (‘MedDev’) companies to use AM printers for implants such as hips and knees, partly for speed and levels of customisation, but also due to the surface characteristics of AM parts. The process produces a rough and porous surface that lends itself well to implants. “When the knee implant is inserted, your bone will latch on to that roughness and start to grow back. That’s only possible with that sort of texture and that sort of latticing [in an AM produced implant],” says Rees. Strong markets for these machines include the US, where patients are willing to pay more for the best outcome for orthopaedics, Ireland’s MedDev hub and parts of Europe.

Recently Italian orthopaedic devices company Permedica bought three RenAM 500Qs to enable the mass production of AM parts.

Federico Perego, Sales Manager, Permedica, says the company chose to invest heavily in additive manufacturing for two reasons. “First is the need to design and produce custom-made devices quickly for our patients/customers. Secondly, we need to produce a growing number of standard products to meet the increasing demands of our market.”

The AM business has had a very strong 12 months, reflecting a clear shift to AM, after the early developmental years where product prices remained high and there was more reticence. “We are seeing the medical and dental market expand fast; as it becomes more mainstream the cost comes down, and demand rises,” Rees says. “Growth now is about both very customised parts made to fit a patient using CT scans, such as customised maxillofacial implants, but increasingly high volume, standard parts production for hips and knees.

UK needs more capable SMEs to match needs of Med Dev sector

The Association of British Healthcare Industries (ABHI) sees change caused by greater demands and pressures on SMEs. Post-pandemic, supply chain problems still exist for a range of materials, particularly with semiconductors. ABHI says long lead times are often mentioned by many UK members for a wide range of products, with components and raw materials compounded by rising costs.

“Members have told us that there is a shortage of UK contract manufacturing capability, with many companies having to go abroad to source parts,” says Jonathan Evans from the ABHI. “A number of organisations have said that they would like to: a) have this capacity at home and b) have it at a competitive price. A further issue is that suppliers often prioritise large orders, or have very large minimum order quantities, that cause problems for UK SMEs in the earlier stages of development.” Some ABHI companies say that many of the components or materials they need are either not manufactured in the UK, or the price of these in the UK are significantly higher than from overseas.

Jonathan adds: “Many SMEs will not have the equipment and skills in-house when it comes to manufacturing at any type of scale and are likely to outsource this to a contract manufacturing organisation, or even a university innovation/manufacturing centre. This clearly shows that there is a huge demand from UK HealthTech SMEs for clinical and scale-up services.” Evidence, then, of a big manufacturing opportunity for companies that can pivot to supply this need, in the required volumes with the necessary accreditation while still managing big supplier constraints.